SmartSaver Savings

Credit Union One of Oklahoma is excited to introduce our new SmartSaver Savings Accounts — designed to help young savers build strong financial habits with rewarding benefits.

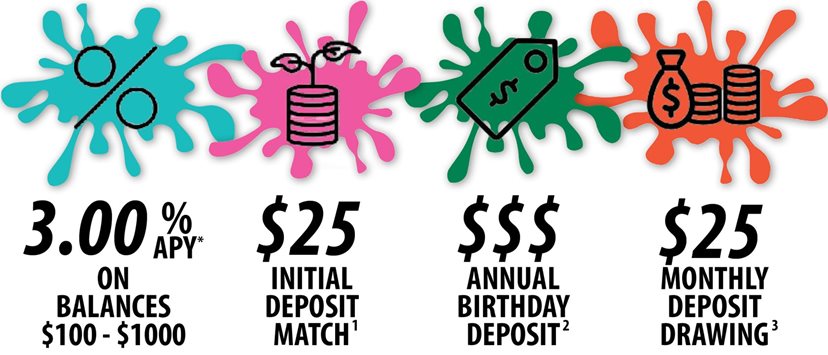

Earn a competitive 3.00% APY on balances between $100 and $1,000, and receive a deposit match up to $25 when opening the account. Each year, during the account holder's birth month, we'll deposit an amount equal to their age — making birthdays even more special. Plus, every month, accounts with a $25 or greater deposit are automatically entered into a $25 drawing, adding an extra incentive to save regularly.

SavvySpender Checking

In addition to our revamped Savings account, we're also introducing our new SavvySpender Checking Accounts — designed to help young adults build strong spending and budgeting habits with rewarding benefits.

Earn a competitive 3.00% APY on balances between $100 and $1,000, and every checking account is automatically enrolled in the MyRewards Plus debit rewards program! As an inventive at account opening, we'll gift you 2,500 bonus points if you use your debit card at least 5 times within the first 45 days of account opening!

In addition, our Savvy Spenders are encouraged to utilize our most tech forward services like mobile banking, eStatements, and Money Movement, our personalized finance manager located within the online and mobile banking platforms.